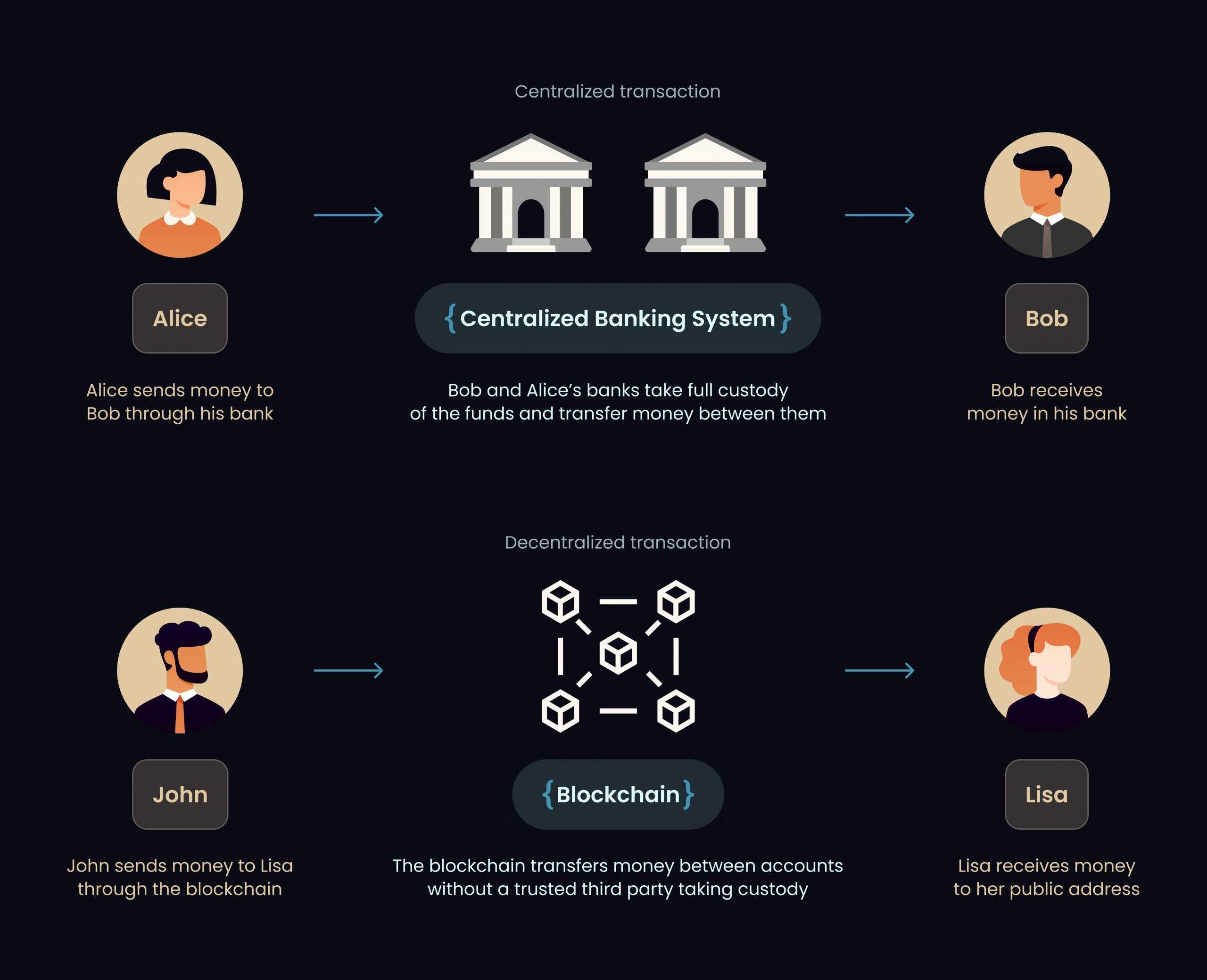

As the decentralized finance (DeFi) landscape matures, the need for efficient, transparent, and user-centric transaction processing is more urgent than ever. Traditional blockchains process transactions sequentially, a model that often results in inefficiencies such as front-running, unpredictable fees, and suboptimal execution for both users and protocols. Modular OrderFlow Auctions (MOFA) have emerged as a transformative solution to these challenges, introducing a new paradigm for on-chain transaction optimization.

Why the Status Quo Needed Disruption

In legacy blockchain systems, transactions are typically included in blocks based on either gas price or miner discretion. This approach has led to widespread issues like MEV (Maximal Extractable Value) extraction by searchers and validators, who profit from reordering or sandwiching user transactions. The result is a fragmented and sometimes hostile environment for everyday users and even sophisticated traders.

The introduction of MOFA blockchain frameworks directly addresses these pain points by creating an open orderflow marketplace. Here, third-party agents, often called solvers or transmitters, compete in real time to execute user-submitted intents. This competitive auction mechanism ensures that transactions are executed not just quickly but with optimal economic efficiency.

The Mechanics of Modular OrderFlow Auctions

At its core, MOFA transforms how value flows through blockspace markets. When a user initiates an on-chain action, whether swapping tokens or bridging assets, their intent enters an auction venue instead of being broadcast immediately to the mempool. Solvers analyze the intent and submit bids reflecting their willingness to execute it based on factors like current gas costs, available liquidity, and prevailing market conditions.

The highest bidder wins the right to fulfill the transaction. This process aligns incentives across all participants: users receive better pricing and lower slippage; solvers compete transparently for execution rights; networks benefit from reduced MEV-related toxicity. Importantly, because all bids are kept private until the auction concludes, risks like front-running are dramatically reduced.

Chain Abstraction: Unlocking Seamless Cross-Chain Activity

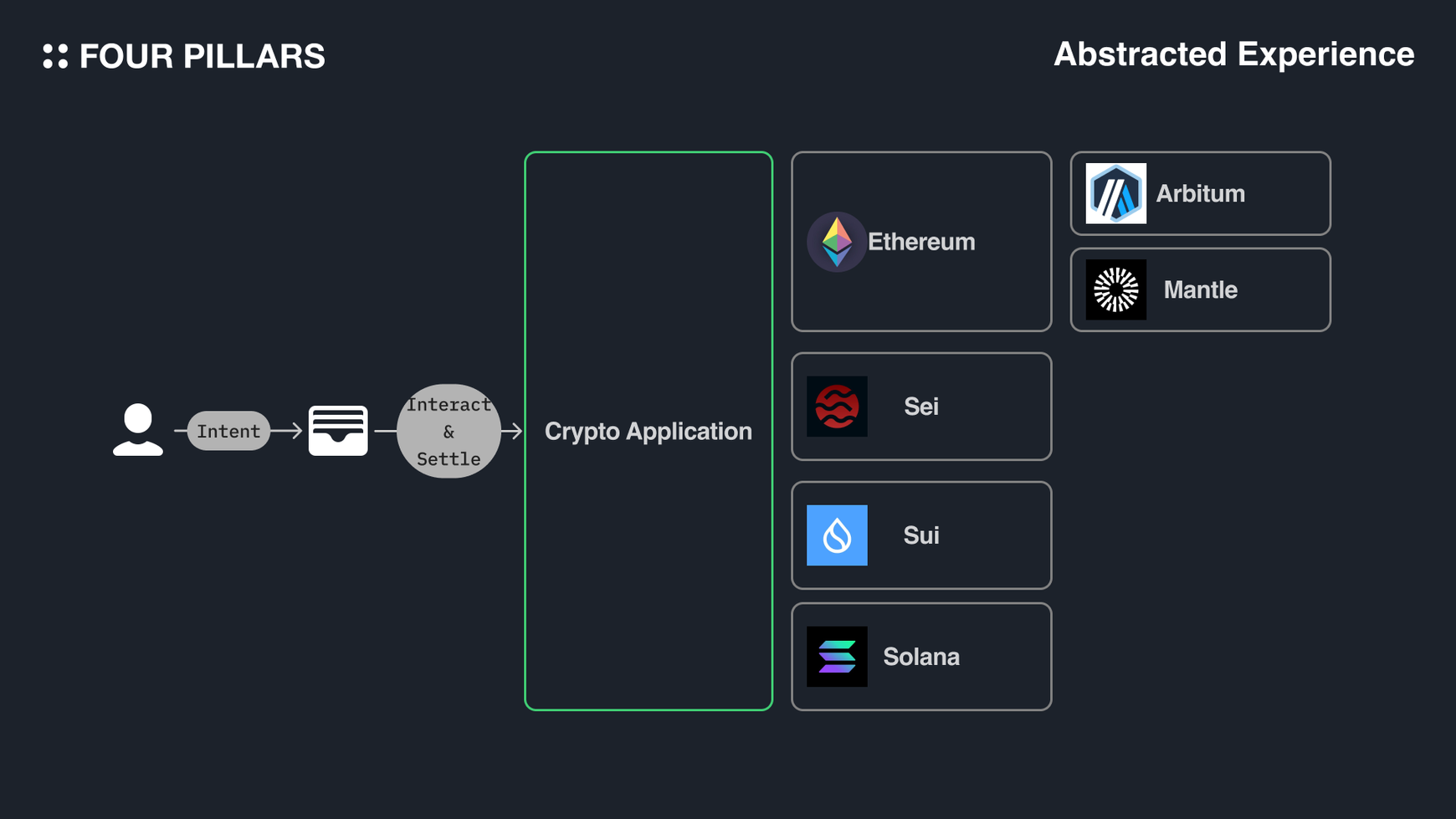

The rise of chain abstraction protocols has further amplified MOFA’s impact. By decoupling transaction intent from specific blockchains, users can interact with multiple networks without worrying about technical details like gas tokens or routing complexity. This chain-agnostic approach is made possible by MOFA’s modular design, allowing execution agents to bid on fulfilling intents across diverse blockchains in a single unified marketplace.

Key Benefits of MOFA for DeFi Traders & Developers

-

Enhanced Transaction Efficiency: MOFA introduces a competitive auction framework where multiple solvers bid to execute user intents, resulting in faster confirmation times and reduced transaction fees compared to traditional sequential processing.

-

Front-Running Mitigation: By batching and concealing orders until the auction concludes, MOFA significantly reduces the risk of front-running and other malicious activities, ensuring fairer execution for all participants.

-

Optimal Execution & Cost Savings: The auction-based model encourages solvers to offer the most cost-effective execution paths, aligning incentives and often resulting in better prices and outcomes for users.

-

Chain Abstraction & Interoperability: MOFA facilitates chain-abstracted intents, allowing users and developers to interact with multiple blockchains seamlessly, which improves cross-chain liquidity and user experience.

-

Developer Flexibility & Modularity: The modular design of MOFA empowers developers to customize transaction flows, integrate with various protocols, and build on top of existing infrastructure, accelerating innovation in DeFi.

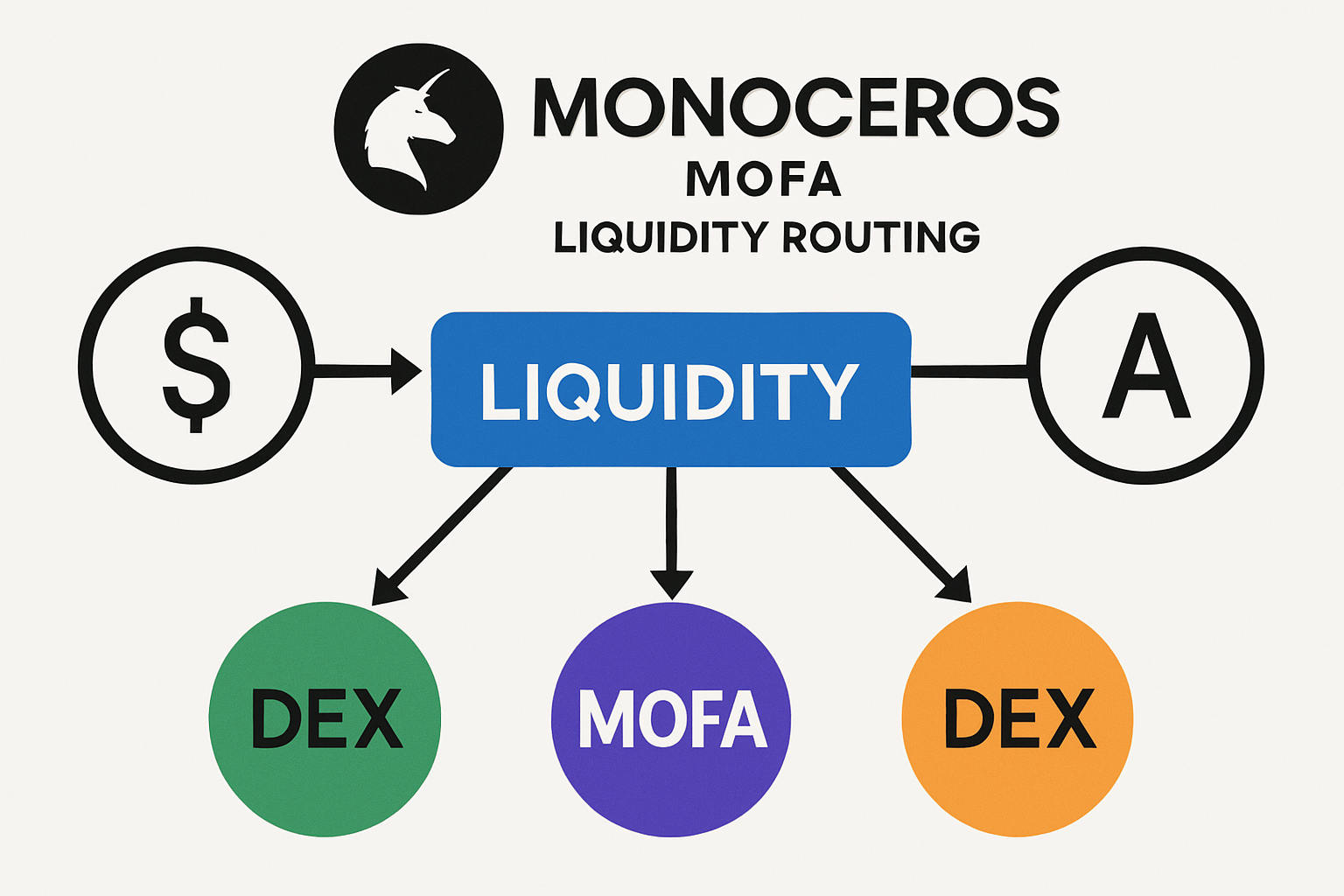

This modular structure not only improves scalability but also unlocks new possibilities for liquidity aggregation and cross-chain arbitrage strategies. As highlighted in research from LI. FI, batching orders in discrete auctions can minimize welfare loss compared to continuous matching models, a crucial factor as DeFi volumes grow.

Looking ahead, MOFA blockchain solutions are poised to become foundational infrastructure for the next wave of DeFi protocols. By abstracting away the technical and economic frictions that have long plagued on-chain execution, MOFA enables developers to focus on building user-centric applications while ensuring that value flows efficiently and securely throughout the ecosystem.

One of the most significant implications of this shift is the democratization of MEV auctions. Instead of a handful of sophisticated actors capturing outsized profits through opaque strategies, MOFA’s orderflow marketplace distributes value more equitably among users, solvers, and protocol stakeholders. This transparency not only fosters trust but also encourages broader participation in decentralized finance, lowering barriers for new entrants and leveling the playing field for all participants.

Real-World Impact: Speed, Cost, and Security

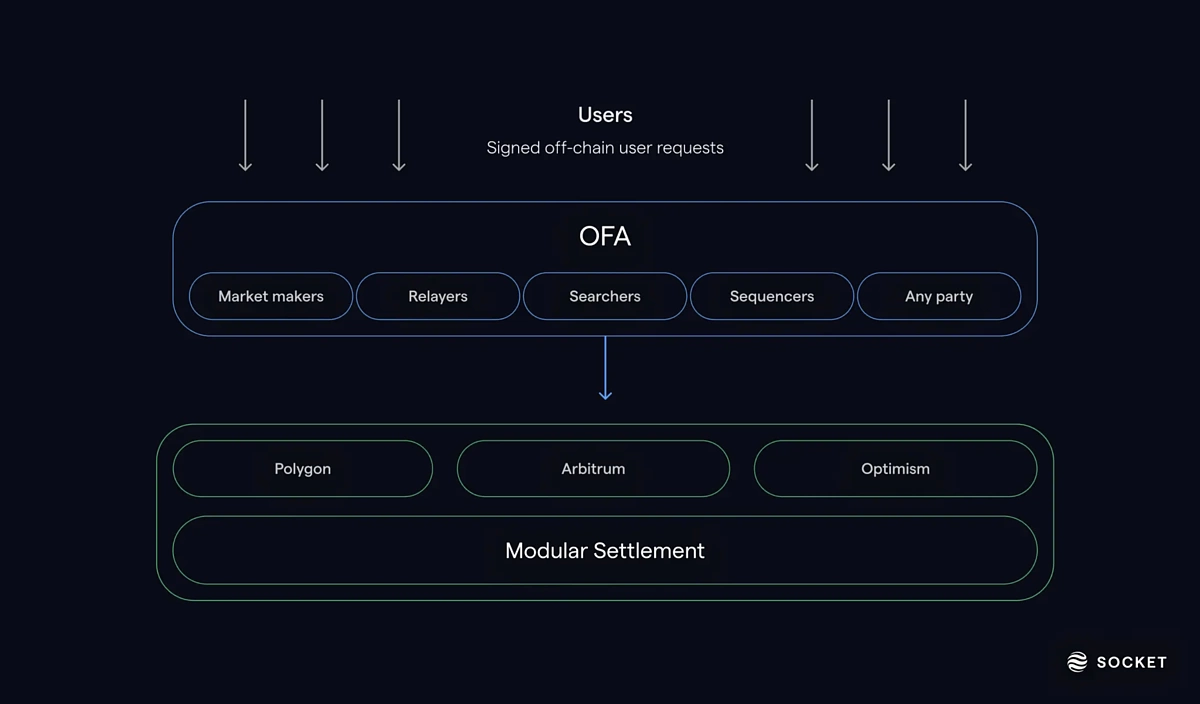

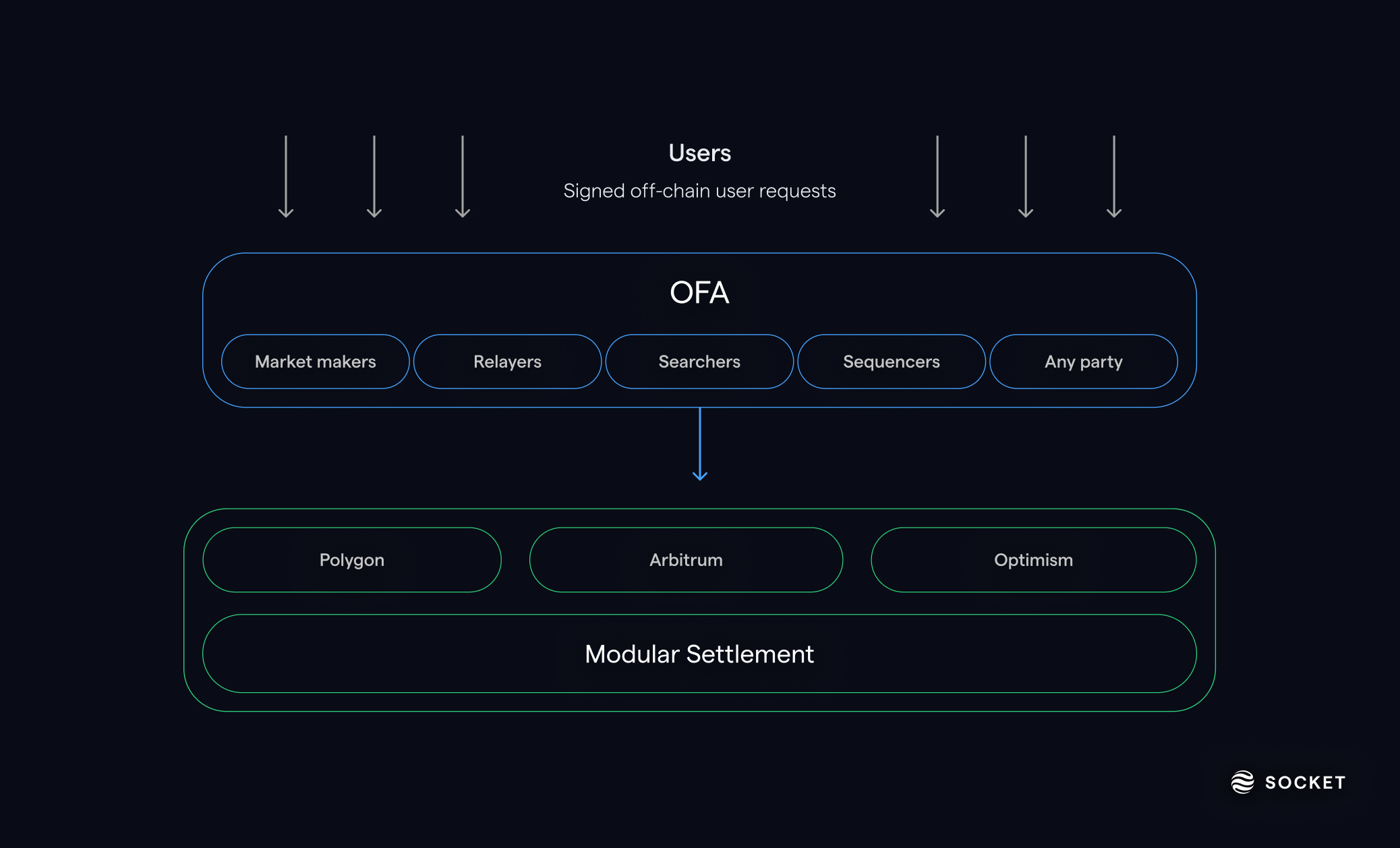

The practical outcomes of adopting Modular OrderFlow Auctions are already being felt across live networks. Users report faster transaction confirmations and noticeably lower fees as competition among solvers drives down execution costs. For platforms integrating MOFA, such as those leveraging Socket Protocol’s chain abstraction layer, there is a marked improvement in liquidity routing efficiency and risk mitigation.

This is particularly relevant when considering cross-chain activity, a notoriously complex challenge in DeFi. With MOFA’s modular approach, intents can be routed seamlessly between blockchains without exposing users to unnecessary slippage or failed transactions due to route fragmentation. The result is a more resilient and accessible financial system that can scale alongside growing demand.

What’s Next for Modular OrderFlow Auctions?

As adoption accelerates, expect further innovations around blockspace market solutions, including dynamic fee models, intent-based privacy enhancements, and integrations with advanced analytics tools. Developers are now empowered to design custom auction venues tailored to specific use cases, whether optimizing high-frequency trading strategies or ensuring fair NFT drops, expanding the reach of on-chain transaction optimization far beyond its current scope.

The ongoing evolution of MOFA frameworks will likely intersect with broader trends in chain abstraction and account abstraction. Together these technologies promise a future where users interact with decentralized applications intuitively, without needing to understand gas mechanics or bridge risks, while developers harness an open orderflow marketplace to maximize both efficiency and user satisfaction.

Top 5 Emerging MOFA Use Cases in DeFi

-

Cross-Chain Asset Swaps: MOFA powers seamless asset transfers between blockchains by enabling transmitters to competitively execute user intents, as seen in Socket Protocol‘s chain abstraction marketplace.

-

Intent-Based Trading: Platforms like LI.FI leverage MOFA to batch and auction user intents, ensuring optimal trade execution and protection against front-running.

-

Gas Fee Optimization: By allowing execution agents to bid on transaction batches, MOFA helps protocols like Everclear minimize gas costs for users through competitive pricing.

-

Decentralized Liquidity Routing: MOFA’s modular auctions are used by projects such as Monoceros to aggregate liquidity and route orders efficiently across multiple pools and chains.

-

Chain Abstraction for User Experience: By abstracting away network complexities, MOFA enables platforms like Socket to deliver a unified, chain-agnostic DeFi experience, simplifying onboarding and transaction management.

For anyone invested in the future of blockchain infrastructure, from traders seeking alpha to builders designing tomorrow’s protocols, the rise of Modular OrderFlow Auctions signals a new era defined by transparency, efficiency, and composability. As research continues (see this recent study) and real-world deployments expand, it’s clear that MOFA will remain at the heart of on-chain transaction innovation for years to come.