Orderflow efficiency is the beating heart of decentralized finance (DeFi) trading. The way transactions are collected, sequenced, and executed determines not only the user experience but also the economic fairness and liquidity of the entire ecosystem. With the proliferation of MEV (Maximal Extractable Value) strategies, traders and developers face a paradox: how can we harness value opportunities without falling prey to network congestion, high fees, and predatory tactics?

Understanding Modular MEV Auctions in DeFi

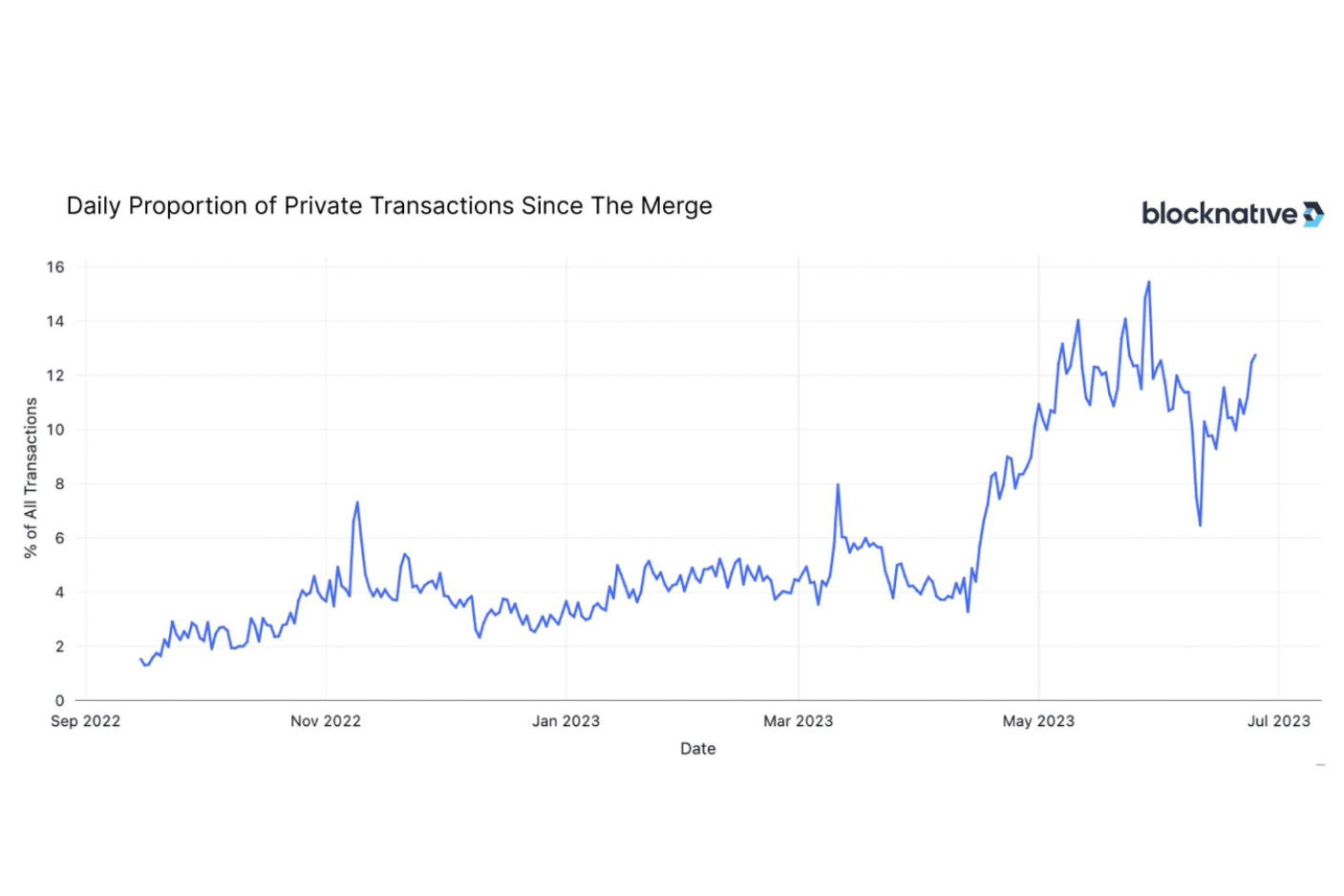

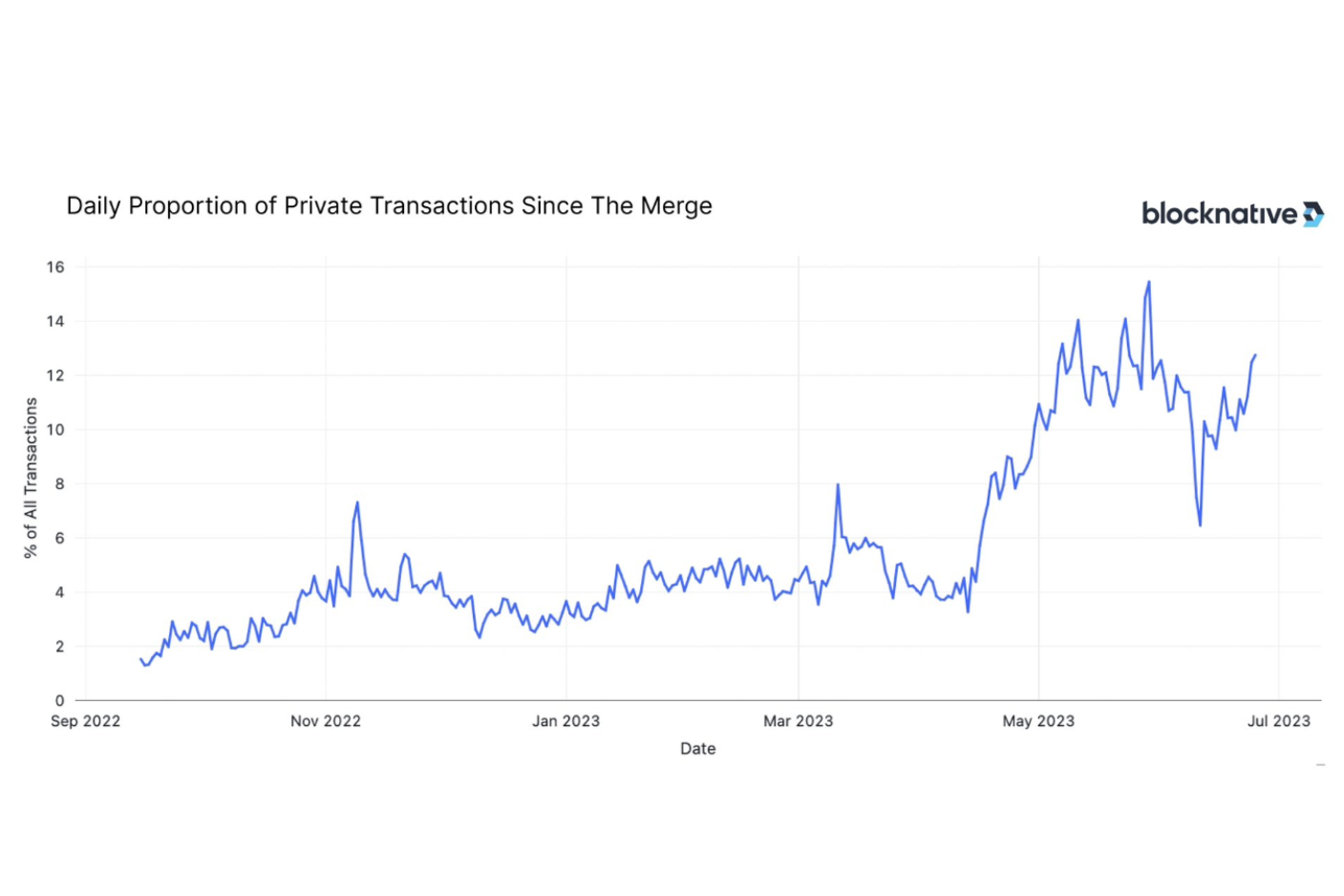

Modular MEV Auctions are rapidly becoming a cornerstone solution for addressing inefficiencies created by traditional MEV extraction. In classic scenarios, sophisticated actors exploit public mempools by reordering or inserting their own transactions, often at the expense of ordinary users. This leads to issues like frontrunning or sandwich attacks, which degrade trust and increase costs across DeFi platforms.

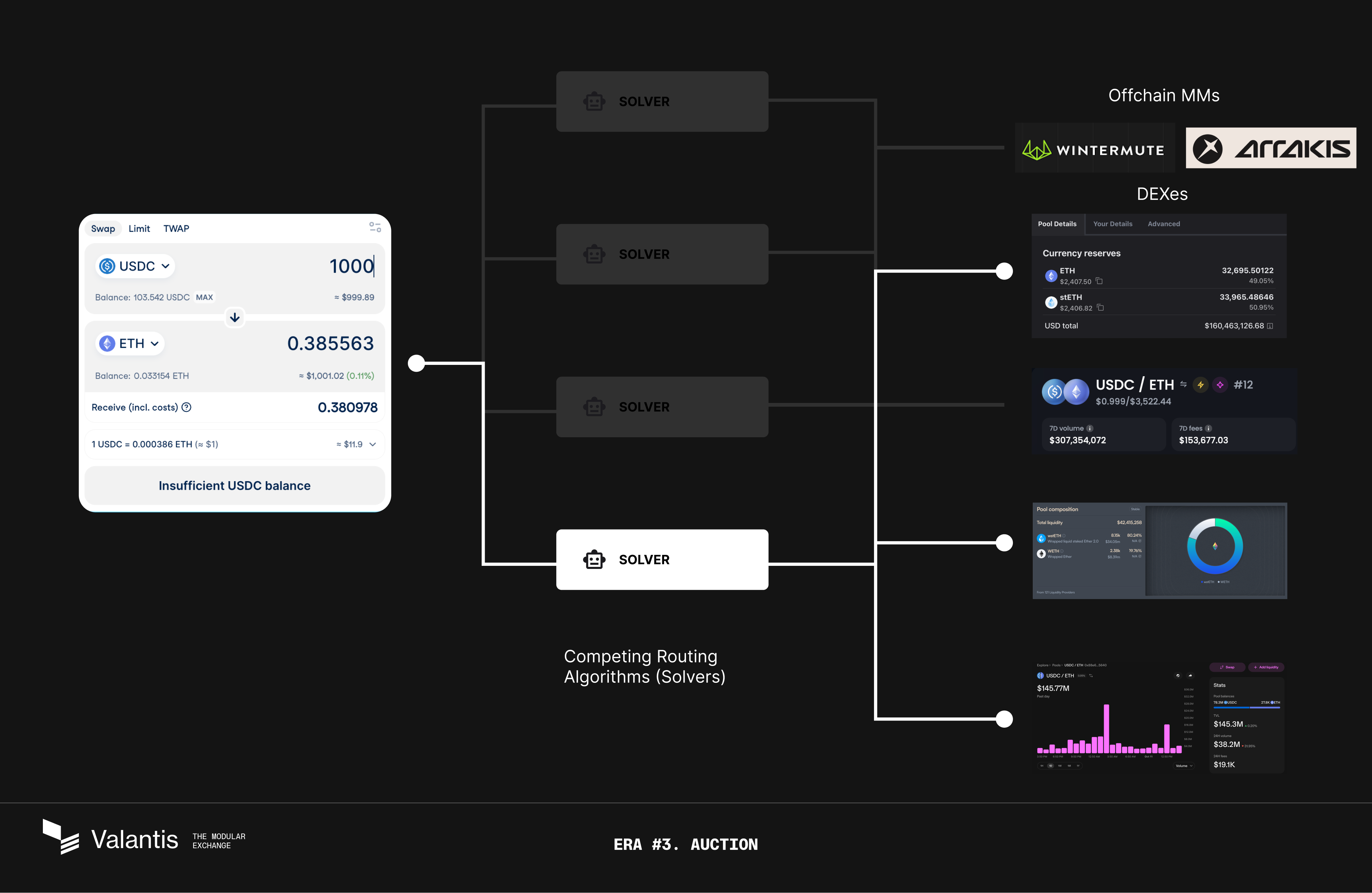

Instead of leaving transaction ordering to chance or whoever pays the highest gas fee, modular MEV auctions introduce a structured marketplace. Here’s how it works: users submit their orders to an auction layer where specialized searchers or builders compete for the right to include those transactions in blocks. The result? A more transparent process that redistributes value more fairly and reduces harmful externalities.

Key Mechanisms Driving Orderflow Efficiency

The real innovation behind modular MEV auctions lies in their design. Let’s break down three core mechanisms:

Key Benefits of Order Flow Auctions (OFAs) for DeFi Traders

-

Enhanced Fairness and User Empowerment: OFAs help level the playing field by reducing the advantage of high-speed traders and bots, allowing everyday DeFi users to capture more of the value their transactions generate.

-

Improved Price Discovery: Competitive bidding among searchers in OFAs leads to more accurate and transparent price formation, benefiting traders with better execution and market efficiency.

-

Lower Transaction Costs: By batching transactions and optimizing block inclusion, OFAs can reduce gas fees and minimize network congestion, making trading more cost-effective for users.

-

Increased Market Liquidity: The transparency and predictability of OFAs attract a broader range of participants, boosting liquidity and enabling larger trades with less slippage.

-

Reduced MEV Exploitation: OFAs redistribute MEV profits more equitably, minimizing the impact of harmful practices like frontrunning and sandwich attacks that have historically disadvantaged regular traders.

- Order Flow Auctions (OFAs): By batching user transactions and auctioning them off to builders or solvers, OFAs ensure competitive bidding for blockspace. This not only levels the playing field but also minimizes exploitative practices that have historically plagued DeFi orderbooks.

- Proposer-Builder Separation (PBS): Separating block proposers from builders decentralizes power over transaction ordering. Proposers select from blocks constructed by competing builders, each striving to maximize inclusion value while minimizing risks like failed execution.

- Failure Cost Penalties: To discourage malicious bidding or unfulfilled commitments, modular auction systems often impose penalties on unsuccessful participants. This mechanism filters out unserious actors and ensures higher quality execution for end users.

The interplay between these mechanisms results in a system where fairness, transparency, and efficiency are prioritized over brute-force gas wars. Notably, this approach aligns incentives across all parties, users retain more value from their trades while builders compete on execution quality rather than speed alone.

The Tangible Benefits for DeFi Traders

The shift toward modular MEV auctions isn’t just theoretical, it’s already delivering measurable improvements in DeFi trading environments:

- Enhanced Fairness: Standardized transaction inclusion processes mean fewer advantages for high-frequency bots and more equitable outcomes for everyday traders.

- Improved Price Discovery: Competitive bidding ensures that blockspace is allocated efficiently, leading to tighter spreads and better price formation across platforms.

- Lower Transaction Costs: Batch processing reduces network congestion and optimizes gas usage, a win-win for both active traders and passive participants seeking cost-effective execution.

- Sustainable Liquidity Growth: By fostering a predictable environment with clear rules of engagement, modular auctions attract greater participation from market makers and liquidity providers alike.

If you’re curious about diving deeper into how these innovations reshape trading dynamics, and how you can leverage real-time auction data or advanced MEV optimization tools, explore further insights at this resource.

Despite the clear upside, the transition to modular MEV auctions is not without nuance. As with any market innovation, there are new tradeoffs and operational complexities to consider. For example, managing the auction infrastructure and ensuring seamless coordination between proposers, builders, and searchers requires robust technical solutions. The risk of centralization, where a small number of sophisticated builders dominate auction outcomes, remains an ever-present challenge that the DeFi community must vigilantly address.

Still, the evidence is mounting: modular MEV auctions are already helping to democratize access to orderflow. By lowering barriers for both retail and institutional participants, these mechanisms foster a healthier competitive landscape. As more protocols adopt OFAs and PBS models, the ecosystem gravitates toward a future where transaction value is distributed more equitably, and where end users reclaim some of the profits previously siphoned away by opaque MEV strategies.

Integration With Blockspace Market Solutions

One of the most exciting developments is how modular MEV auctions dovetail with next-generation blockspace market solutions. By treating blockspace as a dynamic commodity, allocated via transparent auctions rather than backroom deals, DeFi platforms can optimize for both throughput and fairness. Real-time auction data empowers traders to make informed decisions on when and how to route their orders for optimal execution.

For developers and advanced users, MEV optimization tools provide actionable analytics on auction outcomes, slippage risks, and expected returns. These dashboards turn raw transaction data into strategic insights, helping users calibrate their trading algorithms or liquidity provision strategies in line with evolving network conditions.

Checklist: Maximizing Orderflow Efficiency With Modular Auctions

The modular approach also supports experimentation with alternative auction designs, such as batch auctions or hybrid models, that can be tailored to specific protocol needs or user bases. This flexibility ensures that as DeFi matures, its core infrastructure remains resilient against both technical bottlenecks and economic manipulation.

Looking Ahead: The Future of Fairer DeFi Markets

The ultimate promise of modular MEV auctions lies in their ability to align incentives across all participants, from individual traders to large-scale liquidity providers. By prioritizing transparency, reducing predatory tactics, and enabling efficient price discovery, these systems lay the groundwork for a more robust decentralized financial system.

If you’re navigating today’s rapidly evolving crypto landscape, or building tomorrow’s DeFi protocols, keeping pace with advances in orderflow efficiency isn’t optional; it’s essential. Explore detailed guides on implementation strategies or review real-time auction data at our resource hub.