Artificial intelligence is rapidly transforming how traders, developers, and protocols approach MEV (Maximal Extractable Value) auctions. As competition intensifies in the DeFi landscape, the marriage of AI and blockchain is unlocking new levels of speed, safety, and cost efficiency that were simply out of reach for manual or rule-based systems. Let’s dive into how AI-powered execution is reshaping the MEV auction ecosystem, and why these advances matter for anyone optimizing transaction flows or seeking alpha in decentralized markets.

How AI Accelerates MEV Auctions

Speed is everything in MEV. Opportunities like arbitrage and liquidations can disappear in milliseconds. That’s where AI-driven bots come in: by continuously monitoring mempools and leveraging machine learning to spot patterns humans might miss, they identify profitable transactions faster than ever before.

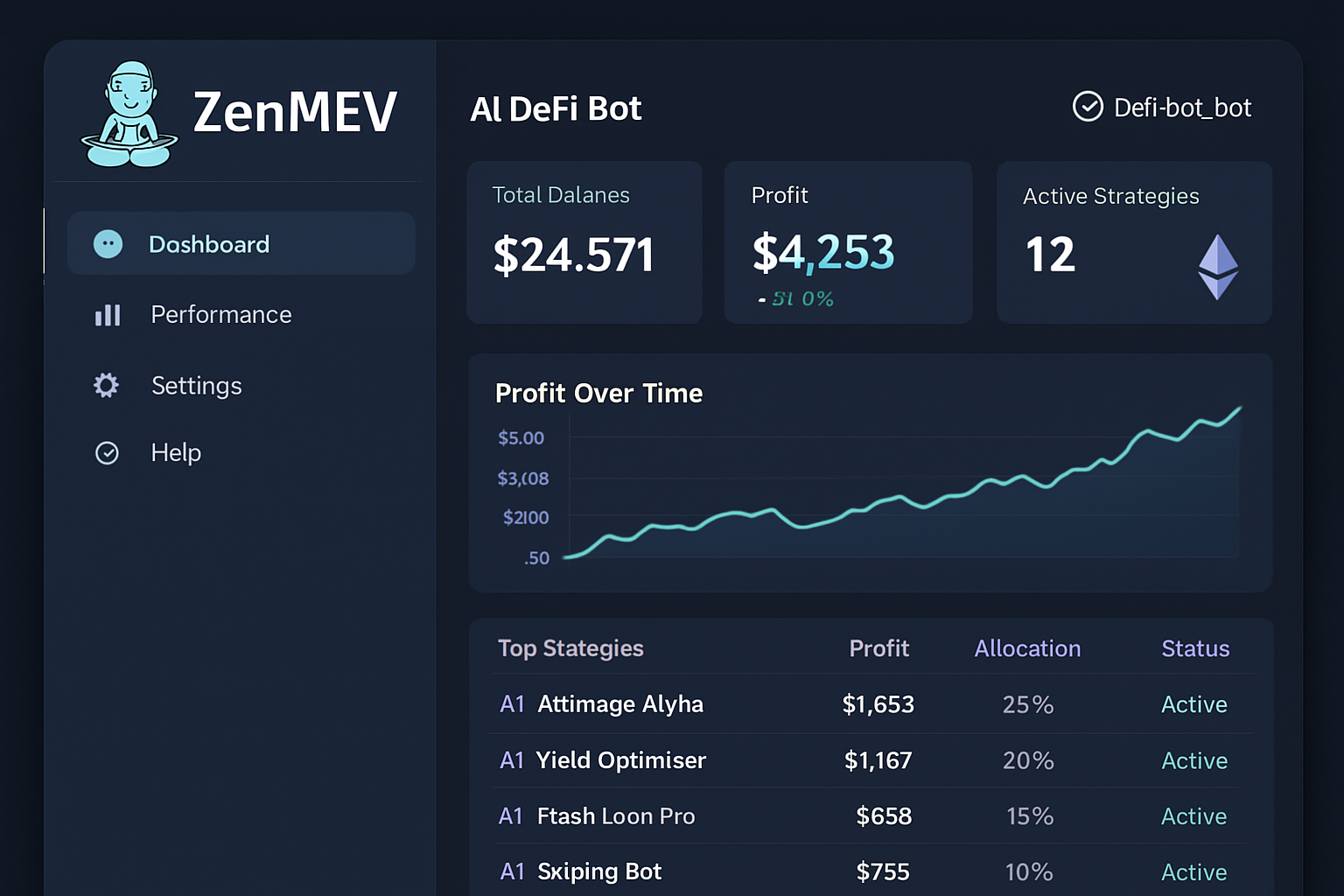

For example, ZenMEV’s system uses deep learning to scan real-time blockchain data, instantly detecting high-value opportunities and executing them with minimal latency (source). This kind of execution speed isn’t just a technical flex, it’s a competitive necessity as more actors crowd into the lucrative orderflow marketplace.

Boosting Safety With Smarter Protocols

The dark side of MEV has always been adversarial behavior: front-running, sandwich attacks, failed transactions that waste gas. Here too, AI is making a difference. By analyzing historical transaction data and simulating possible outcomes, modern AI models can predict which strategies are likely to succeed, and which are likely to be exploited.

Innovative blockchains like SKALE’s FAIR protocol have gone further by integrating threshold encryption at the protocol level. This means transaction details are kept secret until block finalization, neutralizing many classic attack vectors (source). The result? A safer environment for both traders and protocols participating in MEV auctions.

Key Benefits of AI-Driven Execution Engines for DeFi Traders

-

Lightning-Fast Transaction Execution: AI-powered engines like ZenMEV use real-time machine learning to scan mempools and execute profitable MEV strategies—such as arbitrage and liquidations—with minimal latency. This speed is crucial in DeFi, where opportunities can vanish in seconds.

-

Enhanced Security Against Exploits: Platforms like FAIR blockchain leverage AI and threshold encryption to keep transaction details confidential until block finalization. This approach helps prevent front-running and sandwich attacks, making MEV auctions safer for traders.

-

Significant Gas Fee and Cost Reductions: AI-driven systems implement smart batching mechanisms, such as iBatch, to group multiple smart contract calls efficiently. This reduces gas fees per transaction and boosts overall throughput, helping traders save on operational expenses.

-

Intelligent Risk Management: By analyzing historical and real-time blockchain data, AI models can predict market movements and assess the viability of MEV strategies. This proactive risk assessment helps DeFi traders avoid costly transaction failures and adapt to rapidly changing markets.

-

Optimized Transaction Ordering: AI algorithms can dynamically reorder transactions to maximize profitability while minimizing negative impacts like slippage or failed trades. This optimization leads to more consistent and reliable outcomes for DeFi participants.

Pushing Down Costs With Intelligent Automation

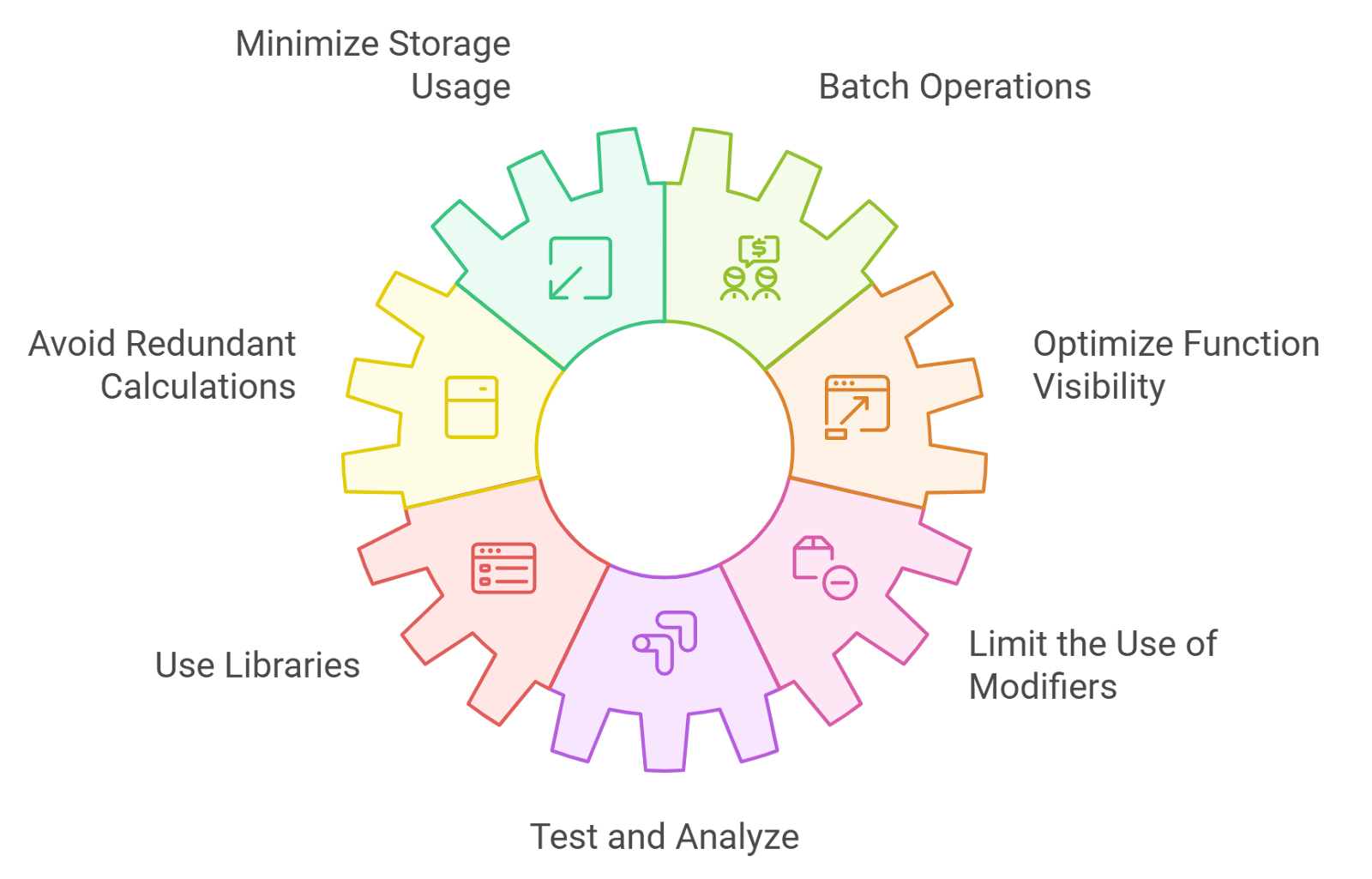

Gas fees and slippage remain persistent headaches for DeFi users, but AI-powered systems are making real headway here as well. Take iBatch: by batching multiple smart contract invocations securely (without introducing extra state), it delivers significant gas savings per transaction (source).

This kind of optimization doesn’t just lower costs; it also improves throughput across busy networks and makes advanced strategies accessible to a broader range of users, not just whales or high-frequency trading firms.

Of course, the impact of AI on MEV auctions isn’t limited to just speed and savings. The evolving landscape is also about transparency and democratization. As more protocols open-source their AI models or offer analytics dashboards, smaller traders and developers gain access to insights that were once the exclusive domain of well-funded searchers or private syndicates. This levels the playing field and encourages healthier competition in the blockspace market.

But with innovation comes new risks. The rise of AI-powered MEV bots has also attracted scammers promising easy profits through so-called “autonomous trading” solutions. It’s crucial for users to distinguish between legitimate automation platforms and fraudulent schemes that prey on less-experienced DeFi participants. Always do your due diligence before integrating any AI-based tool into your workflow.

What’s Next for AI in DeFi Transaction Execution?

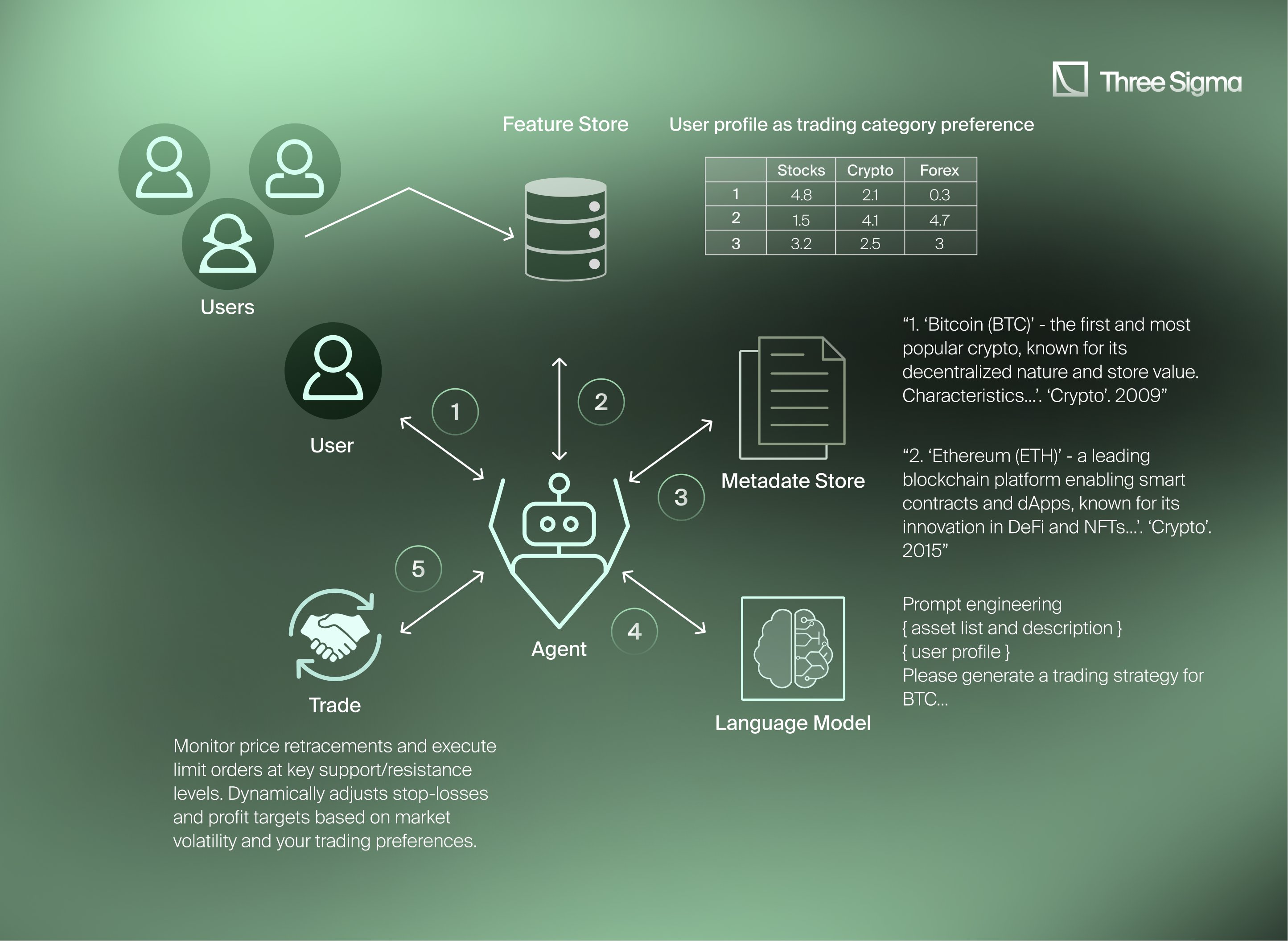

The future is bright, and fast-paced. Expect to see even more sophisticated machine learning techniques deployed in real-time transaction analytics, from reinforcement learning agents adapting to shifting mempool dynamics, to collaborative filtering models that aggregate market sentiment for smarter orderflow routing.

We’re also seeing a wave of privacy-enhancing technologies emerging alongside AI-driven execution. Protocols are experimenting with zero-knowledge proofs and encrypted mempools, aiming to further minimize information leakage while still enabling rapid matching and settlement. The combination of privacy tech and intelligent automation could fundamentally change how value is extracted (and shared) across DeFi ecosystems.

Why This Matters for Every Blockchain Professional

Whether you’re a trader looking to optimize gas costs, a developer building next-gen DEX infrastructure, or an institutional player exploring high-frequency strategies, understanding how AI MEV auctions work is now table stakes. These systems are rewriting the rules around transaction speed in DeFi, reducing operational friction, and unlocking new forms of risk management that benefit everyone, when implemented responsibly.

Top AI Use Cases in Blockchain MEV Auctions

-

Real-Time Mempool Monitoring and MEV Opportunity Detection: Platforms like ZenMEV use AI to scan mempools in real time, identifying profitable MEV opportunities such as arbitrage and liquidations faster than manual or rule-based bots.

-

Enhanced Transaction Safety with Confidentiality Protocols: The FAIR blockchain leverages AI and threshold encryption to keep transaction data private until block finalization, preventing front-running and sandwich attacks in MEV auctions.

-

Optimized Gas Fee Management via Smart Batching: AI-powered solutions like iBatch securely batch smart-contract invocations, reducing gas fees and increasing throughput by validating multiple transactions efficiently within a single block.

-

Predictive Analytics for MEV-Driven Market Movements: Machine learning models analyze blockchain data to forecast market impacts of MEV activity, enabling traders and protocols to anticipate and react to shifting conditions for safer and more profitable execution.

-

Automated Risk Management and Execution Quality Controls: AI systems implement advanced risk protocols, such as failure cost penalties, to ensure high-quality execution and discourage malicious behaviors in permissionless MEV auctions.

The bottom line? The convergence of AI and MEV automation is rapidly reshaping the economics of blockspace. Those who embrace these advances will be best positioned to thrive as DeFi scales into its next era, one marked by smarter execution, lower costs, and greater resilience against adversarial tactics.